A New York senator wants to give banks in the state a little peace of mind about working with legal marijuana businesses, filing a bill on Tuesday that would allow regulators to disclose certain information about cannabis licensees to financial institutions.

The bill from Sen. Jeremy Cooney (D) is one of two pieces of legislation that he’s filing to address the marijuana banking issue, though the other has yet to be formally introduced.

It’s another example of how state lawmakers are taking matters into their own hands as Congress continues to stall on enacting a federal fix to more broadly protect banks and credit unions that service cannabis businesses from being penalized by financial regulators.

Cooney’s new bill, SB S8758, would take a modest step at the state level by authorizing the Office of Cannabis Management (OCM) to “share any and all information obtained from applicants and licensees…to requesting financial institutions for the purpose of consideration and compliance,” the text states.

A justification section for the measure, which has been referred to the Senate Investigations And Government Operations Committee, says that federal prohibition of marijuana “creates challenges to banking licensed cannabis companies.”

—

Marijuana Moment is already tracking more than 1,000 cannabis, psychedelics and drug policy bills in state legislatures and Congress this year. Patreon supporters pledging at least $25/month get access to our interactive maps, charts and hearing calendar so they don’t miss any developments.![]()

Learn more about our marijuana bill tracker and become a supporter on Patreon to get access.

—

“Due to rigorous federal compliance rules and anti-money laundering laws, financial institutions face increased costs and little to no incentive to take on cannabis businesses as clients,” it says, noting that federal guidance in place requires banks to submit suspicious activity reports for marijuana-related transactions, which can be costly and onerous.

The New York bill is meant to help by allowing financial institutions to “have access to verify personal and financial information for their prospective cannabis clients,” which will improve “compliance and make it easier and less costly for financial institutions who want to bank cannabis businesses to comply with the federal reporting.”

The justification also stresses that the lack of banking access for marijuana businesses constitutes a public safety threat, as many are left operating with large volumes of cash that make them targets of crime. It also says the bill would “furthers the social equity goals” of New York’s legalization law by “removing some of the financial and systemic barriers that can prevent individuals from actually participating in the market safely.”

Marijuana Moment reached out to Cooney’s office for comment on the separate pending bill that was first reported by Syracuse NY Cannabis Insider, but a representative was not immediately available.

Separately, New York lawmakers are also seeking to provide tax breaks for the forthcoming marijuana market, approving a budget proposal that Gov. Kathy Hochul (D) signed over the weekend that would do just that.

Cooney filed a standalone bill in December seeking a similar carve-out for the state’s burgeoning cannabis industry, and Assemblymember Donna Lupardo (D) followed suit in her chamber.

Outside of New York, the Pennsylvania Senate on Wednesday approved a bill to safeguard banks and insurers against being penalized by state regulators for working with state-legal medical marijuana businesses. It’s now scheduled for floor consideration on Wednesday.

The bill, which previously advanced through the Senate Banking & Insurance Committee late last month, would not immunize banks and insurers from potential federal repercussions—but it’s an interim step meant to signal to the financial sector that they at least won’t face penalties under state law.

The move to provide state-level protections could also add pressure on congressional lawmakers to enact a federal change, such as the bipartisan Secure and Fair Enforcement (SAFE) Banking Act that has passed the House in some form six times at this point, only to stall in the Senate.

One possible vehicle for that congressional policy change could be a large-scale manufacturing and innovation bill, where marijuana banking was included by the House and may now be taken up by appointed negotiators in both chambers as they head to conference.

Rodney Hood, a board member and former chairman of the National Credit Union Administration (NCUA), has repeatedly emphasized the urgent need for a federal resolution to the marijuana banking problem. He recently applauded efforts by lawmakers in states like Pennsylvania to address the issue within their jurisdictions, but he said it’s not enough.

Washington State Treasurer Mike Pellicciotti (D) has also been especially vocal about the need for congressional reform, and he wrote in a recent letter to his colleagues in other states that it’s “just not safe to have this financial volume in cash.”

Pellicciotti made similar remarks at a recent conference of the National Association of State Treasurers (NAST). And Colorado Treasurer Dave Young echoed that sentiment in a recent interview with Marijuana Moment.

The sponsor of the congressional SAFE Banking Act, Rep. Ed Perlmutter (D-CO), told Marijuana Moment on Monday that he’s hopeful that his reform legislation will be attached to the final America COMPETES Act that’s heading to conference.

The congressman pointed out that “more than two-thirds of the conferees [for the large-scale bill] have already voted for or cosponsored the SAFE Banking Act.”

One of those conferees, longstanding marijuana reform champion Rep. Earl Blumenauer (D-OR), said in an op-ed for Marijuana Moment this week that the banking reform measure as “a huge step” toward public safety and equity in the industry.

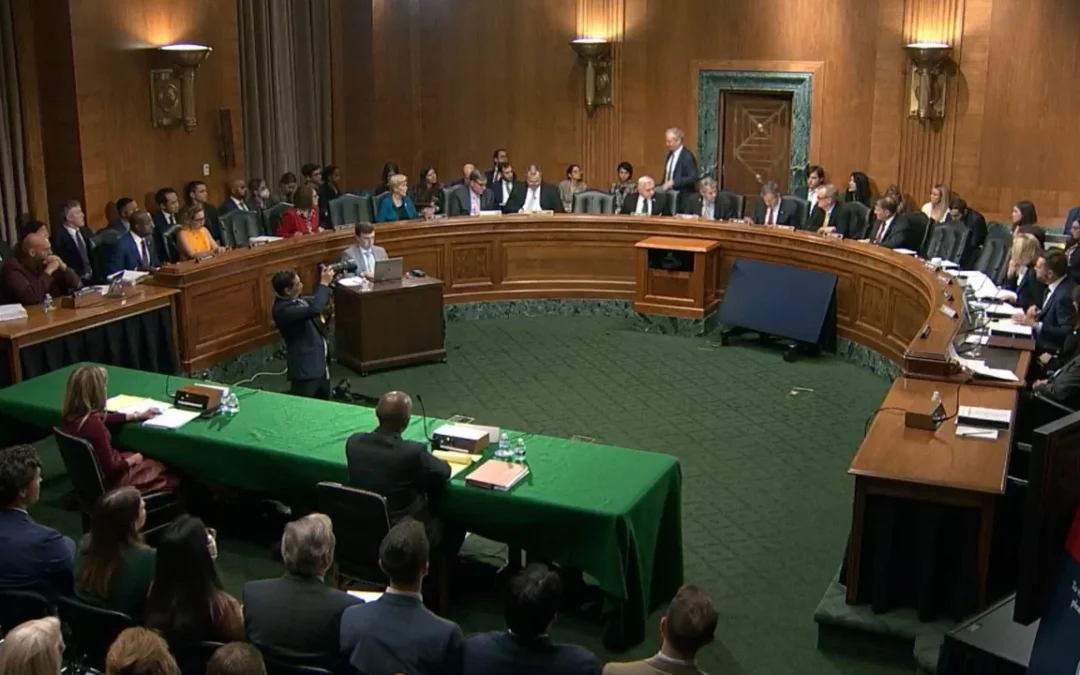

Perlmutter also recently spoke with Treasury Secretary Janet Yellen about the marijuana banking issue during a hearing of the House Financial Services Committee. And the secretary said that it’s “extremely frustrating” that Congress hasn’t “been able to resolve it.”

The sponsor has even made a point to talk about enacting the reform legislation during committee hearings on ostensibly unrelated or wider-ranging legislation, like at a recent House Rules Committee hearing.

At a recent event hosted by the American Bankers Association (ABA), the congressman said that he will “continue to be a real pest, and persistent in getting this done” before he retires from Congress at the end of the session.

Despite recently saying that he’s “confident” that the Senate will take up his bill this session, Perlmutter recognized that while he’s supportive of revisions related to criminal justice reform, taxation, research and other issues, he knows that “as we expand this thing, then we start losing votes, particularly Republican votes and we got enough votes in the Senate to do it” as is.

Ahead of last month’s ABA event, the financial group released a poll that it commissioned showing that a strong majority of Americans support freeing up banks to work with marijuana businesses without facing federal penalties.

Meanwhile, the number of banks that report working with marijuana businesses ticked up again near the end of 2021, according to recently released federal data.

It’s not clear if the increase is related to congressional moves to pass a bipartisan cannabis banking reform bill, but the figures from the Financial Crimes Enforcement Network (FinCEN) signal that financial institutions continue to feel more comfortable servicing businesses in state-legal markets.

Some Republicans are scratching their heads about how Democrats have so far failed to pass the modest banking reform with majorities in both chambers and control of the White House, too. For example, Rep. Rand Paul (R-KY) criticized his Democratic colleagues over the issue in December.

Back in New York, the banking bill is just one step that state lawmakers and officials are taking to prepare to launch the recreational marijuana industry. Regulators advanced a rule last month to make it so people with prior marijuana convictions, or whose family members have been harmed by criminalization, will get the first round of adult-use marijuana retailer licenses—ahead of existing medical cannabis businesses. A recent poll found that most New Yorkers voters are against that proposal.

The state has also taken separate steps to get the industry in a position to have products available by creating provisional marijuana cultivator and processor licenses for existing hemp businesses that take certain steps to promote equity in the emerging industry. Hochul signed that legislation in February.

Assembly Majority Leader Crystal Peoples-Stokes (D), who sponsored the legislation that created the legalization law and recently launched an equity-focused political action committee that will place a strong focus on electing candidates that support marijuana reform, said that “we are doing what no other state has done by focusing on the people most criminalized by cannabis prohibition, and promoting New York farmers.”

As it stands, adults 21 and older can possess and publicly consume cannabis, as well as gift marijuana to other adults as long as they aren’t being compensated. But regulators are still finalizing licensing rules, and there are currently no retailers that are authorized to sell cannabis for adult use in the state.

Hochul has repeatedly emphasized her interest in efficiently implementing the legalization law.

The governor released a State of the State book in January that called for the creation of a $200 million public-private fund to specifically help promote social equity in the state’s burgeoning marijuana market. That funding, called the “New York Social Equity Cannabis Investment Program,” is the last component of the Seeding Opportunity Initiative.

Hochul said that while cannabis business licenses have yet to be approved since legalization was signed into law last year, the market stands to generate billions of dollars, and it’s important to “create opportunities for all New Yorkers, particularly those from historically marginalized communities.”

That proposal was also cited in the governor’s executive budget, which was released in January. The budget also estimated that New York stands to generate more than $1.25 billion in marijuana tax revenue over the next six years.

Enacting legislation that expedites licensing could help the state reduce the number of businesses that are effectively using the legal “gifting” provision of the state’s marijuana law to give away cannabis for “free” if a non-marijuana-related purchase is made.

New York regulators recently issued warnings to more than two dozen businesses that they allege are either illegally selling marijuana without a license or exploiting the “gifting” component.

Here are some other ways that New York lawmakers and regulators are working to build upon the legalization law as the state prepares to implement retail sales:

In February, for example, a state senator filed a bill that would promote recycling in the marijuana industry once retail sales officially launch.

Sen. Michelle Hinchey (D) is also sponsoring that legislation, which would require cannabis shops to apply a $1 deposit for any marijuana products sold in single-use plastic containers and also reimburse consumers for that fee if they return the container.

The senator is also behind a separate bill filed last year that would prioritize hemp-based packaging over synthetic plastics for marijuana products.

The recycling bill is identical to an Assembly version filed by Assemblywoman Patricia Fahy (D) last year.

The state Department of Labor separately announced in recent guidance that New York employers are no longer allowed to drug test most workers for marijuana.

Meanwhile, a New York lawmaker introduced a bill in June that would require the state to establish an institute to research the therapeutic potential of psychedelics.

Another state legislator filed legislation in December to legalize psilocybin mushrooms for medical purposes and establish facilities where the psychedelic could be grown and administered to patients.

Meanwhile, as New York prepares the launch of its adult-use marijuana market, OCM announced a significant expansion of the existing medical cannabis program.

Now doctors will be able to issue medical marijuana recommendations to people for any condition that they feel could be treated by cannabis, rather than rely on a list of specific eligible maladies.

Majority Of Democratic Voters Say Marijuana Legalization Should Be A Priority For Democratic Congress

Photo courtesy of Mike Latimer.

The post New York Senator Files Bill To Promote Marijuana Banking By Giving Financial Institutions Access To Business Information appeared first on Marijuana Moment.